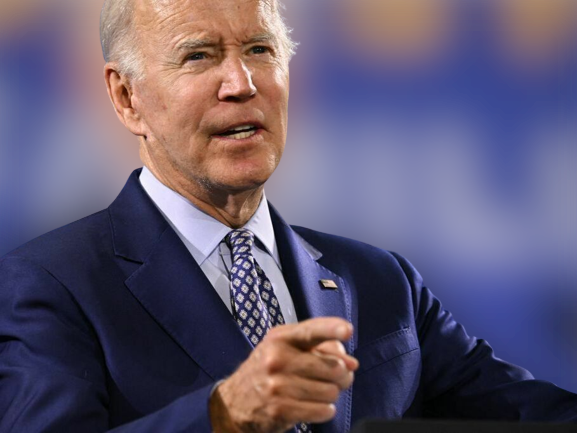

” Biden’s pupil loan remission program is facing new challenges to its perpetration.

In light of the Supreme Court’s decision to cancel President Biden’s pupil loan remission plan, conservative groups are targeting their other sweats to cancel loans for numerous Americans. On Friday, the Cato Institute and the Mackinac Center for Public Policy filed a action challenging Biden administration’s plan to cancel$ 39 billion in civil pupil loans held by over 804,000 borrowers who have been making disbursements for further than 20 times.

The birth of automatic loan remission comes from the Education Department’s sweats to amend decades of mismanagement in its income- driven prepayment programs and is set to be in the coming weeks.

The groups argue that this is a violation of civil law as the administration didn’t go through the process of making it a rule and did not give the public with an occasion to be involved in it. Representing the program in the action, Sheng Li, an attorney with the New Civil Liberties Alliance, said,” A program of this magnitude should have been done through rulemaking.”” The administration can not apply such a policy without going through proper channels.”

The Education Department didn’t incontinently respond to commentary on the action. The issue is that the department’s decision allows remission for those borrowers who have been on forbearance for times, counting those times towards pupil loan remission. The groups contend that Congress never gave the government the authority to classify non-payments as payments when it enacted the first income-driven scheme in the 1990s.

They claim the same is true for public service loan remission, where public sector andnon-profit workers can have their loans forgiven after 10 times of service. As part of the income- driven prepayment program, the department also gave remission for the times of extended forbearance to those working in public service. The groups are prompting the prayers court to declare the forbearance- credit policy illegal, abate it, and stop the cancellation of pupil loans grounded on it.

Their argument is that if borrowers can admit remission in lower than 10 times, the policy unfairly harmsnon-beneficiaries by reducing the value of their PSLF benefit. Both associations used analogous arguments in separate successful cases challenging Biden’s broad pupil loan cancellation program.

In its original round of Covid relief laws, Congress said the months when borrowers broke payments a form of forbearance- would count for PSLF, indeed if they weren’t enrolled in IDR.

At that time, the department estimated that loosening the rules would affect in at least three million people getting an redundant time of remission. Grounded on that estimate, the Cato Institute and the Mackinac Center claim that the$ 39 billion in loan cancellation is just a bit of the true cost of the program. According to the complaint, assuming that the per- borrower cost of cancellation remains unchanged, the program could affect in a loss of$ 175 billion to taxpayers in payments and interest.

This case comes a many weeks after the Education Department started notifying eligible borrowers about the easy loan remission. The advertisement drew review from Republicans, who characterized it as the Biden administration despising the Supreme Court’s decision, which halted the broad loan cancellation program without Congress’s blessing.

president of the House Education Committee, Representative Virginia Foxx( R- NC), said,” The Biden administration’s blatant casualness for the rule of law is opprobrious.”” The administration is stamping on the law, hurting creditors, and misusing taxpayer plutocrat for political gain.

” This isn’t the first time that the Cato Institute or the Mackinac Center has fought against Biden’s pupil loan programs. The libertarian think tank Cato had preliminarily filed a action against the Education Department last time, arguing that the President exceeded his authority. The Mackinac Center for a Free Market is still grueling several extensions of the pupil loan payment pause in court.